The Golden Arrow Fund (GAF)

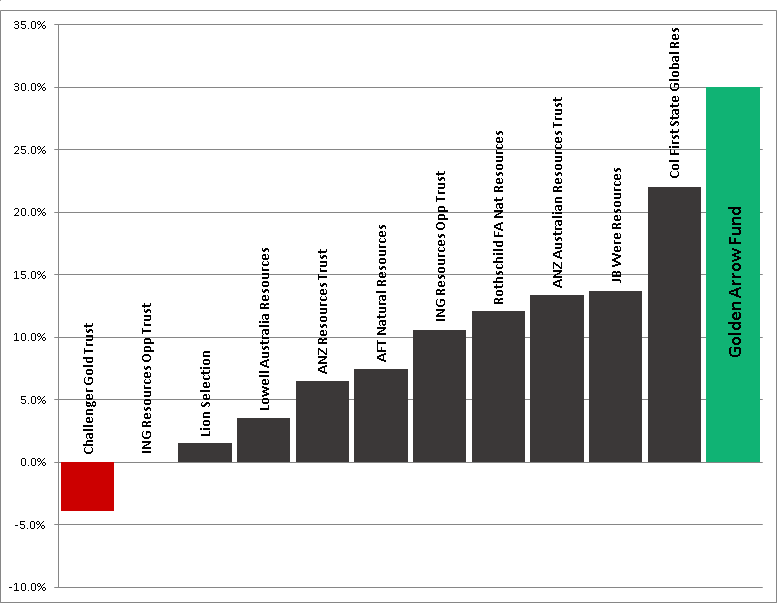

The GAF achieved an annual return of approximately 30% net of all fees and expenses over the period September 1997 to September 2002. It significantly outperformed all major indices (Graph 1). Graph 2 demonstrates the performance of the GAF against a collection of pure resource funds in Australia. GAF was the best performer in the resources sector with the closest competitor achieving an annual return of only circa 13% compared to GAF’s circa 30% annual return. The Management Team has created a niche in the resources sector by investing in the higher growth phases of investee companies with world class assets.

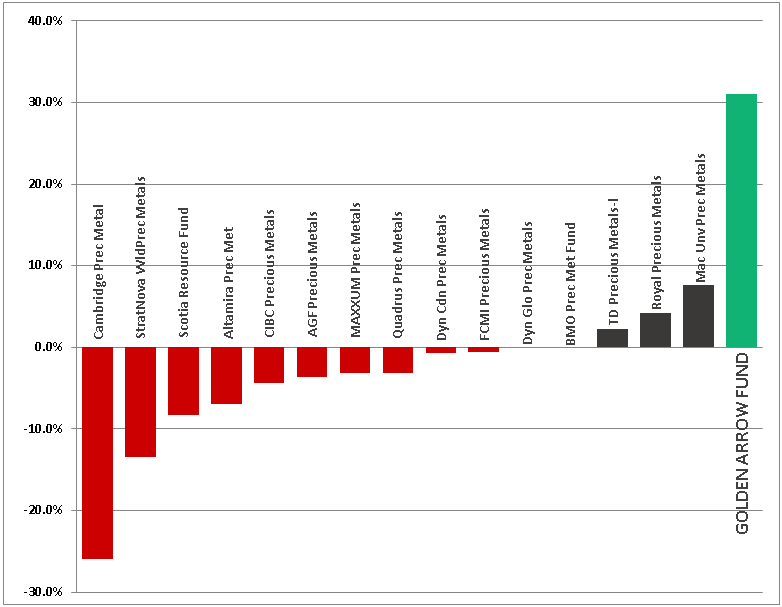

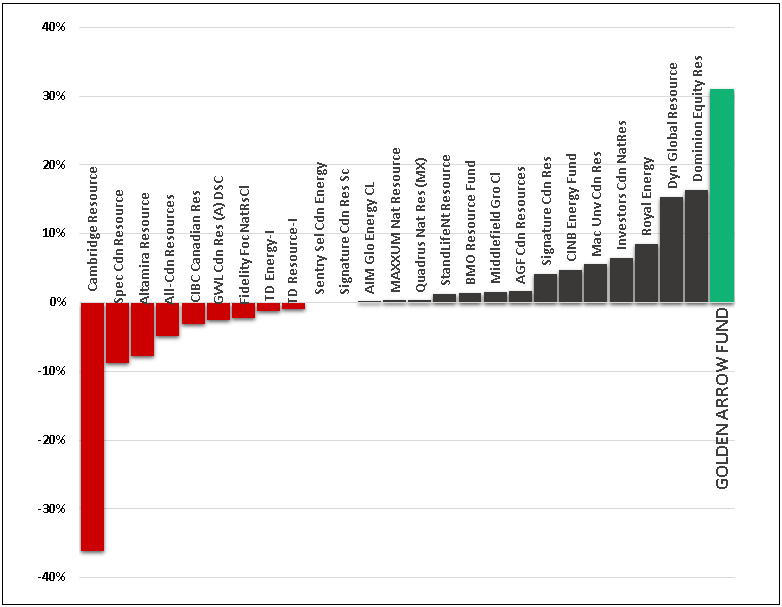

The excellent performance of GAF is also clearly evident when it is compared to Australian resources funds and offshore precious metals funds and natural resources funds (Graphs 2, 3 and 4). For instance, when compared to Offshore Precious Metals Funds 1997-2002 (Graph 3), the average performance of these funds is circa -5%, with approximately two thirds of these funds generating a negative return, compared to GAF’s approximate 30% annual return.

Graph 1: Comparison of Golden Arrow Fund/LMF to major international Indices September 1997 to September 2002

Source: Bloomberg, Iress, Rothschild (Sept 2002)

Graph 2: Australian Resources Funds 5-year % average annual compound return 1997-2002

Source: Morningstar (2002)

Graph 3: Offshore Precious Metals Funds 1997-2002 5-year % average annual compound return

Source: Financial Post Canada 2002

Graph 4: Offshore Natural Resources Funds 1997 to 2002 5-year % average annual compound return

Source: Financial Post Canada 2002

Golden Arrow Fund was established in April 1997 and operated in one of the toughest resources investment environments of the previous 30 years. GAF over the period 1997 to 2002 generated annual returns for investor of approximately 30% net of all fees and expenses making it one of the best performing fund in its sector globally. This outperformance can be attributed to:

-

High level of technical due diligence;

-

Structuring of its Investments, creating and not buying Investments;

-

Active management of Investee Companies;

-

Focus on returns, not funds under management;

-

Successful divestment strategy; and

-

Committed and experienced Management Team