The LinQ Resources Fund (LRF)

The LinQ Resources Fund (ARSN 108 168 190) (”LRF”) was an actively managed investment scheme, which successfully listed on the Australian Securities Exchange on 20 January 2005. LinQ Capital Limited (ACN 098 197 258) was the Responsible Entity which operated LRF.

LRF specialised in investments in a niche market of smaller to medium sized resources companies both in Australia and abroad, generally with market capitalisation below $3 billion. LRF invested in companies at all stages of development - from exploration through to production in a wide variety of mineral commodities, in particular (but not limited to) precious metals, base metals, bulk minerals (potash and iron ore) and energy (coal and gas).

The substantial experience of LRF's Manager further provided guidance and mitigated associated risk for investments into companies that were pre-cash flow i.e. in later stage exploration and in the economic evaluation phases, between discovery and completion of bankable feasibility studies. Companies in these stages are often valued substantially lower than producers and are generally re-rated upwards once they achieve their various milestones and achieve producer status.

Investments were typically held longer term. LRF utilised a variety of investment instruments which assisted in risk mitigation, such as convertible notes and structured finance, whilst providing an income stream. LRF also positioned itself to gain from sustainable direct cash flow streams via investments in joint ventures, royalties and inventory financing.

LRF aimed to provide both significant yield and capital growth for its investors. In addition to capital growth of its underlying investment portfolio, LRF provided distributions annually on average of 6.8% p.a. LinQ’s core skills set is to optimise the risk return profile from its investments by understanding the risk profile of the project development cycle and being capable to structure investments such that the investment risk is minimised while retaining the potential to maximise investment returns.

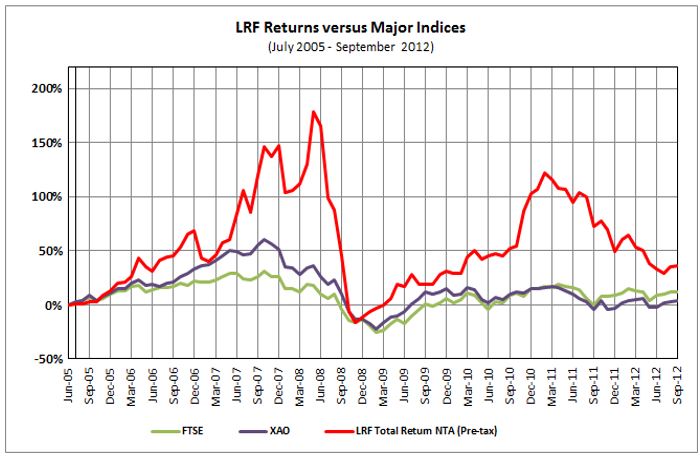

Track Record

Portfolio Performance

| Period |

TR NTA (pre-tax) |

| July 2005 - June 2006 |

31% |

| July 2006 - June 2007 |

41% |

| July 2007- June 2008 |

44% |

| July 2008 - June 2009 (GFC) |

- 56% |

| July 2009 - June 2010 |

25% |

| July 2010 - June 2011 |

34% |

| July 2011 - June 2012 |

- 32% |

| July 2012 - Sept 2012 |

2.2% |

LRF versus Major Indicies

Typical Life Cycle and Risk Returns of a mining project